Companies of all sizes and industries use notes receivable, which benefit both sides of the purchase equation. However, companies must use the accrual method of accounting and follow some specific rules when recording notes receivable. This can make bookkeeping cumbersome, especially for companies that hold multiple notes receivable. A company lends one of its important suppliers $10,000 and the supplier gives the company a written promissory note to repay the amount in six months along with interest at 8% per year. The company will debit its current asset account Notes Receivable for the principal amount of $10,000. Notes receivable are amounts owed to the company by customers or others who have signed formal promissory notes in acknowledgment of their debts.

The amount of payment to be made, as listed in the terms of the note, is the principal. An automated financial management system, such as NetSuite Cloud Accounting Software, simplifies the journal entry process and integrates with cash management to more easily manage notes receivable. This entry eliminates from Sparky’s books the accounts receivable from JPG for the original invoice and establishes the new note receivable, due in six months. Assets such as bank deposits, accounts receivable, and long-term investments in bonds and stocks lack physical substance, but are not classified as intangible assets. Receivables can be classified as accounts receivables, trade debtors, bills receivable, and other receivables. The numerator of the ratio includes “quick assets,” such as cash, cash equivalents, marketable securities, and accounts receivable.

Using Notes Receivable to Generate Cash

Let us understand the intricacies of how a notes receivable account is maintained and the details of the entries with the help of a couple of examples. For example, the maker owes $200,000 to the payee at a 10% interest rate, and pays no interest during the first year. The note has now been completely paid off, and ABC has recorded a total of $246 in interest income over a three-month period. For the entity doing the lending, also known as a payee or creditor, notes receivable can improve cash flow.

For example, a note dated 15 July with a maturity date of 15 September has a duration of 62 days, as shown below. Let us understand the advantages and disadvantages of a notes receivable account through the discussion below. Promissory NoteA promissory note is defined as a debt instrument in which the issuer of the note promises to pay a specified amount to a party on a particular date. A company’s auditors will examine the classification of notes receivable from the most conservative perspective, and so will insist on their classification as short-term if there are reasonable grounds for doing so. This transaction results in a decrease in accounts receivable and an increase in cash or equivalents. A write-off does not affect the net realizable value of accounts receivable.

What Are Notes Receivable?

The difficulty of determining the number of years over which benefits will be received normally encourages the company to write these costs off over a fairly short period of time. These assets are financial instruments and derive their value from the right or claim to receive cash or cash equivalents in the future. Note that the calculation omits inventory and a different version of the formula involves subtracting inventory from current assets and dividing by current liabilities.

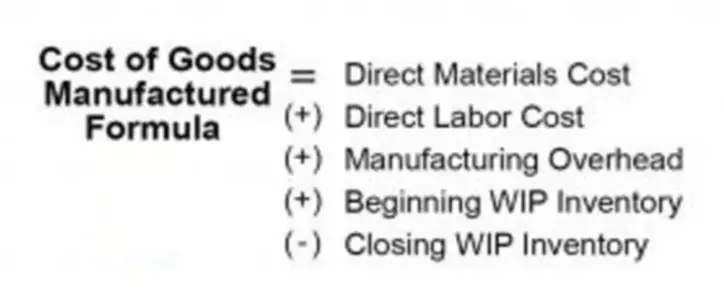

However, even after 35 days, Y ltd could not make the payment of the specified amount to the X ltd. Hence, with the consent of both of the parties, it was decided that X ltd will receive the notes receivable with a principal amount of $ 500,000 and a 10% interest rate to be issued by Y Ltd. It had a condition that $ 125,000 would be paid along with interest due at the end of each month for the next four months. When a promissory note is accepted, it is accounted as a note receivable, which becomes a current asset if it is a short-term or a payment that shall be paid within one year. The interest income on notes receivable is recognized on the income statement. Therefore, when payment is made on a note receivable, both the balance sheet and the income statement are affected.

Notes Receivable Terms

All the terms and conditions are in writing, so there will be no doubt about the borrower’s obligations after making notes. Except where noted, content and user contributions on this site are licensed under CC BY-SA 4.0 with attribution required. The costs of the copyright should be allocated to the years in which the benefits are expected to be received. Others note that with a purchased intangible, a reliable number for the cost of the intangible can be determined. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Notes receivable are considered current assets if they are to be paid within one year, and non-current if they are expected to be paid after one year. It is not unusual for a company to have both a Notes Receivable and a Notes Payable account on their statement of financial position. Notes Payable is a liability as it records the value a business owes in promissory notes. Notes Receivable are an asset as they record the value that a business is owed in promissory notes. A closely related topic is that of accounts receivable vs. accounts payable.

Notes receivable are considered current assets if they are to be paid within 1 year and non-current if they are expected to be paid after one year. Amounts owed to the company by customers or others who have signed formal promissory notes in acknowledgment of their debts. To record a note receivable, you will need to debit the cash account and credit the notes receivable account. Both notes receivable accounts receivable and notes receivable can be used to generate immediate cash. The principal part of a note receivable that is expected to be collected within one year of the balance sheet date is reported in the current asset section of the lender’s balance sheet. The remaining principal of the note receivable is reported in the noncurrent asset section entitled Investments.

- In other cases, a customer’s credit rating may cause the seller to insist on a written note rather than relying on an open account.

- Accounts Receivable is debited for the full maturity value, including the principal and unpaid interest.

- Accounts receivable and notes receivable that result from company sales are called trade receivables, but there are other types of receivables as well.

- More sophisticated terms and real-world circumstances can quickly complicate the straightforward example above and cause Sparky exponential accounting work.

- Companies of all sizes and industries use notes receivable to facilitate sales with longer, interest-bearing payment terms.