Content

Gross income includes “all income from whatever source,” and is not limited to cash received. Gross income includes net gains for disposal of assets, including capital gains and capital losses. Losses on personal assets are not deducted in computing gross income or adjusted gross income. Gifts and inheritances are excluded.

Premium tax credit refers to a U.S. tax credit that is provided by the IRS to help eligible households with low to moderate incomes purchase health insurance through a healthcare exchange. In this case, MAGI is calculated by taking AGI plus foreign-earned income, tax-exempt interest, and the tax-free portion of social security benefits. When it comes time to do your taxes, most people will seek the help of a CPA or a tax software. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office.

Disadvantages Of Roth Iras Every Investor Should Know

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000.

Your MAGI and whether you and your spouse have retirement plans at work determine if you can deduct traditional IRA contributions. If neither spouse is covered by a plan at work, you can take the full deduction, up to the amount of your contribution limit. However, if either spouse has a plan at work, your deduction could be limited. Modified adjusted gross income is an important number.

Magi Vs Agi

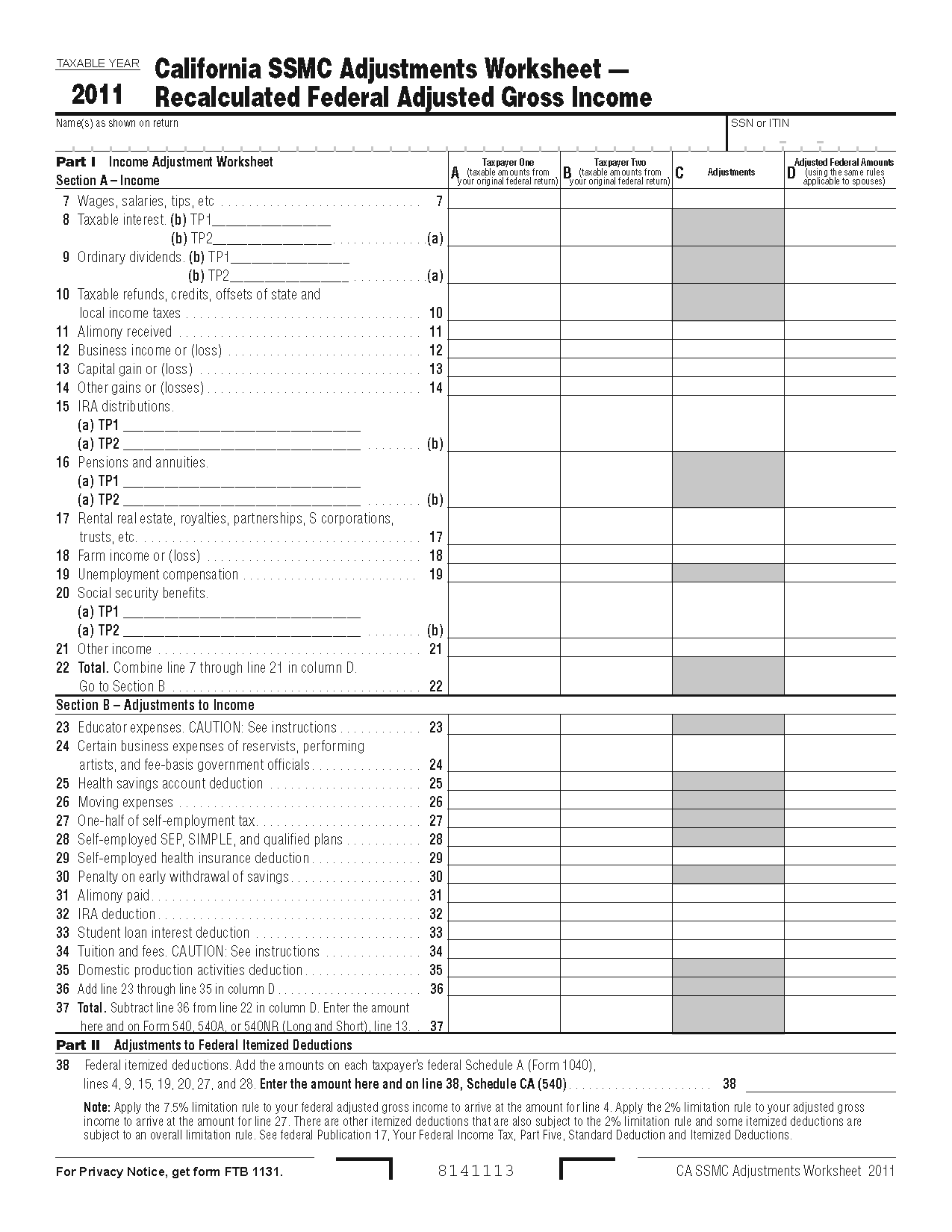

Supporting schedules and forms are required in some cases, e.g., Schedule B for interest and dividends. Income of business and rental activities, including those through partnerships or S corporations, is reported net of the expenses of the business. These are reported on Schedule C for business income, Schedule E for rental income, and Schedule F for farm income. Modified adjusted gross income is a further ‘adjustment’ or ‘modification’ of your adjusted gross income by adding back some of the expenses you initially deducted. The goal is to ascertain that people who eventually qualify for these tax benefits or programs genuinely need it while ensuring that everyone pays their fair share in taxes.

- Modified adjusted gross income is a further ‘adjustment’ or ‘modification’ of your adjusted gross income by adding back some of the expenses you initially deducted.

- Your wireless carrier may charge a fee for data usage.

- The exchange also uses MAGI to determine if and how much a customer will save on health insurance plans.

- Figuring out your MAGI may seem complicated, but it’s still worth doing if it means finding out whether you qualify for certain tax breaks.

- The exact MAGI calculation will vary for each case.

Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required.

Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. The Affordable Care Act offers premium tax credits to help eligible individuals and families purchase individual health insurance coverage through the Health Insurance Marketplace.

Under the Affordable Care Act, eligibility for income-based Medicaid and subsidized health insurance through the marketplaces is calculated using your household MAGI. You ‘modify’ your AGI by adding back some of the adjustments or expenses that you initially deducted. These ‘adjusted’ incomes ensure that you don’t pay taxes on every cent you earn, i.e. your gross income. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Turbotax Guarantees

A Roth IRA is a retirement savings account that allows you to withdraw your money tax-free. Learn why a Roth IRA may be a better choice than a traditional IRA for some retirement savers. A backdoor Roth IRA allows taxpayers to contribute to a Roth IRA even if their income exceeds the IRS-approved amount for such contributions. An individual retirement account is a tax-advantaged account that individuals use to save and invest for retirement. Yes, MAGI and AGI can be the same. For many people, the list of deductions that need to be added back to AGI in order to calculate MAGI will not be relevant.

Fortunately, it’s easy to calculate. Once you know your MAGI, you can shop the ACA marketplace or your state exchange for plans. These sites will ask for your MAGI and household size, then calculate tax credits for you. There are also online premium tax credit calculators, like this one from the Kaiser Family Foundation that can help you estimate your tax credit ahead of time.

The IRS provides instructions on how to calculate MAGI for whichever purpose it is needed. MAGI also determines if a person is eligible for income-based health insurance coverage on a health insurance exchange. Calculated by taking the adjusted gross income and adding back certain allowable deductions. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

MAGI is a common factor when buying health insurance coverage through a state health insurance exchange. Most insurance providers use MAGI as a baseline when determining eligibility for insurance coverage. The exchange also uses MAGI to determine if and how much a customer will save on health insurance plans. The modified adjusted gross income is calculated differently depending on the purpose for which it is being computed and the tax benefit under evaluation.

Your adjusted gross income and your modified adjusted gross income are likely to be fairly close in value to one another. Your AGI is the total amount of income you make in a year, minus certain deductible expenses. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

Because MAGI involves adding back these deductions, MAGI will always be greater than or equal to AGI. However, you can’t deduct those contributions when you file your tax return if your MAGI exceeds limits set by the IRS and you and/or your spouse have a retirement plan at work. If you amended your tax return, and it changes the income we count to determine the income-related monthly adjustment amounts , let us know. Social Security needs to see a copy of the amended tax return you filed and your acknowledgment receipt from IRS. We’ll update our records with the information you provide, and correct or remove your income-related monthly adjustment amounts, as appropriate. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage. If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS.

Bankrate.com does not include all companies or all available products. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. Social Security receives the information about your prescription drug coverage from CMS.

Consult an attorney for legal advice. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.

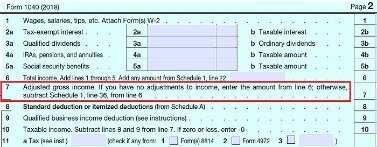

Refer to the 1040 instructions PDF for more information. Your adjusted gross income is important because it’s the total taxable income calculated before itemized or standard deductions, exemptions, and credits are taken into account. Your adjusted gross income takes your total income and tweaks it slightly by subtracting certain deductions allowable by the IRS. Your modified adjusted gross income is a subset of your total income. Your total income consists of all types of earnings you received during the year, such as wages, salaries, tips and commissions. You can find your total income on line 22 of your Form 1040.