Content

This deduction is particularly advantageous because it’s above the line on Schedule A, which means you don’t have to itemize to take it and it reduces your overall adjusted gross income . Legislation in 2015 indexed the deduction amount to inflation, but it remains unchanged at $250 for 2020. If both spouses filing jointly are educators, each can claim the deduction, for a total of $500. This above-the-line deduction has become even more important since the 2017 tax reforms, which virtually doubled the standard deduction, setting the threshold even higher for choosing to itemize.

Paula Strozyk, an instructional coach at John Newbery Elementary School in Wenatchee, Wash., has spent $215 on personal protective equipment this year. That includes four masks that are transparent, so her students can see how her mouth moves during phonics instruction, two face shields, one pair of goggles, 20 KN95 masks, and eight washable masks. Tax-Sheltered Annuity Plans(403 Plans) for employees of Public Schools and Certain Tax-Exempt Organizations. This is a retirement plan for certain employees of public schools, employees of certain tax-exempt organizations, and certain ministers. If you missed this deduction in 2018 or 2019 because of uncertainty around whether the deduction was still allowed, you can now go back and take advantage of it. Schools also report your qualifying expenses to the IRS on Form 1098-T. The good news is, you don’t have to be up-to-date on this as the eFile.com Tax App will automatically report the correct tax breaks on your return based on your answers to several simple questions.

She also wanted to make sure she was wearing masks that were thick enough. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. If your expenses exceed $250, you used to be able to treat the amount over as unreimbursed employee expenses—if the money spent exceeded 2% of your AGI. Deductions related to homeschooling—or in pre-school, undergraduate, or graduate school settings—are not allowed. NEA, NEA Member Benefits and the NEA Member Benefits logo are registered service marks of NEA Member Benefits. If there is no additional withholding on this outside work, you want to be sure to avoid a penalty for under-withholding—i.e., when your overall tax liability exceeds the amount of tax you had withheld by certain margins.

Information Menu

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

The total adjustments to income from Schedule 1, line 22, is then transferred to line 10a of the 2020 Form 1040. You may be able to deduct interest you pay on a qualified student loan. Generally, the amount you may deduct is the lesser of $2,500 or the amount of interest you actually paid. See Publication 970 for information on what to do if you receive a refund of qualified education expenses during the tax year. Eligible expenses also include student activity fees you are required to pay to enroll or attend the school.

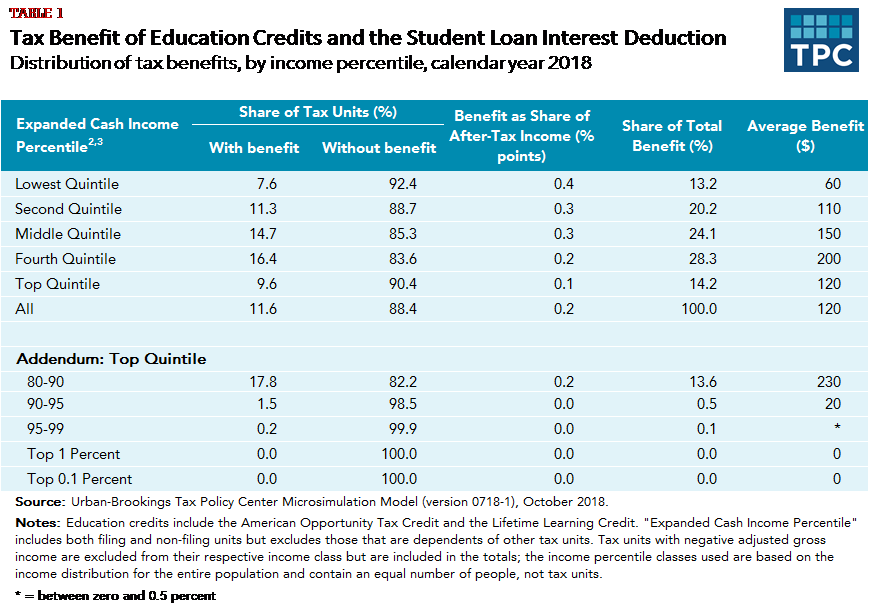

For example, if you are a new graduate student who is still paying undergraduate loans, you qualify for the LLC along with the student loan tax deduction. Although changes to tax law in 2018 eliminated some popular tax deductions for education expenses, there are still deductions and credits available for students and recent graduates in 2020. Expenses for sports, games, hobbies or non-credit courses do not qualify for the education credits or tuition and fees deduction, except when the course or activity is part of the student’s degree program. For the Lifetime Learning Credit only, these expenses qualify if the course helps the student acquire or improve job skills. Educators must work in a school that provides elementary or secondary education, as defined by the laws of their states. The school you work in must, therefore, be certified by your state, or you can’t qualify for the deduction.

Tax Deductions For Educator, Teacher Expenses

You can still subtract the standard deduction or the total of your itemized deductions from your AGI to arrive at your taxable income. Adjustments to income, including the educator expense deduction, are in addition to these other tax breaks. The Internal Revenue Service radically revamped the 1040 tax form in 2018 and revised it again for the 2019 and 2020 tax years. The deduction for educator expenses appears on line 10 of the 2020 Schedule 1.

Many provisions of the tax code have income caps and phase-outs and other wrinkles that may affect your actual tax liability. Be sure to work with a tax advisor orreliable tax softwarethat clearly addresses your situation, especially if you are in the higher income brackets. And keeping receipts or a careful log is critical for the classroom supplies deduction and other tax benefits. A last-minute tax revision in Congress in 2019 retroactively extended the deduction for college tuition and fees, which had expired at the end of 2017, to include the tax years 2018, 2019 and 2020. This allows you to deduct up to $4,000 above the line, so you don’t have to itemize to claim it. Barring new legislation, that deduction has now expired starting in 2021. Despite the fact that educators have had to work at home during the pandemic, there has been no change in eligibility for the home office deduction.

You also may be eligible to claim the Educator Expense Deduction for professional development courses related to teaching that were not reimbursed by your school or by another source. The convenience of employer test is used to determine whether home-office expenses or other work-related expenses paid by an employer are taxable. The IRS uses your modified adjusted gross income to determine if you qualify for certain tax benefits. “Tax reform brought significant changes to itemized deductions.” Accessed Feb. 14, 2020. Educators who work in pre-school environments—or in undergraduate or graduate school settings—also cannot take this deduction. If this is the first year you’ve had extra income, there won’t be any penalty, because your withholding at work will cover 100% of your previous year’s income. If you regularly have extra income, consider specifying a certain additional amount on your W-4 to be withheld.

The educator expense deduction allows eligible educators who teach in kindergarten through grade 12 classrooms to deduct up to $250 a year in qualified out-of-pocket expenses. The $250 above-the-line deduction for classroom supplies is still available for the 2020 tax year.

The American Opportunity Credit is actually a modified replacement to the Hope Credit that was created under the American Recovery and Reinvestment Act . It’s a bit different than the Hope Credit in that it can be claimed for four years of post-secondary education, instead of just two. A few years back, Mrs. 20SF returned to school to complete a post-secondary accelerated nursing degree program, without any government or other assistance. While comparatively inexpensive – she went the community college route – it was still a big out of pocket cost. Education organizations, including the AFT, have said schools will need additional aid, and characterized this bill as a down payment. The COVID-19 relief deal gives about $57 billion in direct aid to K-12 schools. The legislation says schools can use much of that money to address learning loss, to improve school facilities and infrastructure to reduce the risk of transmitting the coronavirus, and to purchase education technology.

Here’s a rundown of what’s changed and what’s stayed the same for the 2020 tax year, as well as how you can make sure you receive all the coronavirus relief funds you’re entitled to. As of the 2017 tax year, which was filed in 2018, you can no longer use the tuition and fees deduction. Income adjustments in the American Opportunity Tax Credit and Lifetime Learning Credit reduce and phase out the deduction within specific income brackets.

At eFile.com, we guarantee a 100% accurate tax return and the biggest possible tax refund allowed by law. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Remember, with TurboTax, we’ll ask you simple questions and fill out all the right forms for you to maximize your tax deductions. Cuts in educational funding now make it necessary for students and teachers to pitch in on everything from tissues for the classroom to gas money for sports team travel.

You are also liable for “payroll” taxes on the extra income, which is calculated on a Schedule SE. The 2020 CARES Act for COVID-19 relief provided another above-the-line deduction. That means that even if you don’t itemize, you can deduct up to $300 for donations to 501 public charities, and the cap applies to both individuals and those married and filing jointly. This is not limited to educators, but like the educator expense deduction, it enables you to reduce your AGI. Additionally, self-employed people or those who work for small companies can take the cost of training and education off their taxes, thanks to this education deduction.

Eligible Teachers Can Claim Up To $250

The deduction is further limited by income ranges based on your modified adjusted gross incomes . High-income individuals may find that they don’t qualify for this deduction. Check the chart below for a breakdown of the thresholds in the 2020 tax year. Those who are married and file jointly can claim this deduction if one of the spouses attended school. This deduction is available to taxpayers who paid tuition and other required fees for attending college or another post-secondary school. Parents can deduct tuition for their child as long as the student was their dependent. The IRS has special qualifications for married couples where both people work as educators.

The tuition and fee education tax deduction was renewed for 2020, as result of a previous Congressional budget deal. However, it was repealed for 2021 with the Taxpayer Certainty and Disaster Tax Relief Act of 2020. The deduction is claimed as an above-line adjustment to income so you do not need to itemize your deductions. You can claim the credits for any amounts not refunded if the student withdraws. Teachers whose schools are entirely remote have had to spend more than normal this school year, too.

Many teachers have had to purchase new technology for remote instruction, or more school supplies than normal to limit students sharing. Learn more about other tax deductions you might qualify to claim on your tax return. We at eFile.com are pleased to recognize, thank, and reward teachers, educators, and students during the 2021 Tax Season. Therefore, all Free Basic Edition Tax Returns are free and all other returns are 50% off. If you e-File your taxes on eFile.com with a valid .edu email address, enter promo code 19edu50 during checkout. The maximum amount you can claim for the tuition and fees adjustment to income is $4,000 per year.

If you wish to take this deduction, be sure to keep all receipts of purchases made that you wish to claim. You can easily claim the Educator or Teacher deduction when you prepare and efile your federal income taxes on eFile.com.

Education Tax Credits & Deductions: Updated For 2020 & 2021

We will always update our site with the most recent tax law changes. However, when you prepare and e-file your tax return on eFile.com, you don’t have to worry about which tax breaks have changed.

- Previously, ESAs could be used for this, but contributions were capped at $2,000 per year.

- While comparatively inexpensive – she went the community college route – it was still a big out of pocket cost.

- Make sure that you have good records and are working with school administrators or the principal to get the appropriate records to support the claim.

- Qualified expenses are amounts you paid or incurred for participation in professional development courses, books, supplies, computer equipment , other equipment, and supplementary materials that you use in the classroom.

Educational expenses like the cost of research if you need to purchase any published work. Not be a personal loan from a friend or family member, even if it accrues interest. Covered the cost of attending school at least half-time in an accredited degree program. You can also deduct the costs of professional development courses you take—again presuming that no one reimburses you. For more information about this, the COVID-related Tax Relief Act of 2020 and other tax changes, visit IRS.gov. Any reimbursements you receive for expenses that aren’t reported to you in box 1 of your Form W-2.

Even better is that this deduction comes “right off the top” of your gross income and is not part of itemization. Considering recent changes to the tax structure that nearly doubled the standard deduction for many people, thus eliminating the need to itemize, this is an important issue. It used to be that schools supplied students with everything they needed to gain an education from kindergarten through grade 12, including costs to compete in athletics or participate in after-school groups. To determine if your EAP qualifies for this form of tax deduction, talk with your supervisor or the financial office at your company. Interest on revolving lines of credit that you use to make student loan interest payments. The Protecting Americans from Tax Hikes Act of 2015 made the above-the-line educator expense deduction permanent, however, and it indexed it for inflation, too, although the limit has remained at $250 from 2015 to 2020.