Content

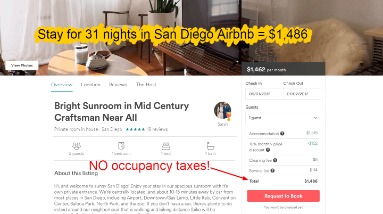

These regulations provide a set of standards governing the renting or leasing of residential property on a short-term basis. All residential short-term rental properties are required to obtain a Short-Term Rental Permit. The City levies an11%Transient Occupancy Tax for the privilege of occupying any space where accommodations are offered for hire for periods of thirty days or less. The tax is paid by the occupant and collected by the operator.

Have a Certificate of Authority issued by our office; if applicable.

For many of these, the actual taxing authority is left to local administration, sometimes by an agency more closely aligned with tourism and economic development instead of finance or tax collection. The imposition of an occupancy tax doesn’t depend on whether a jurisdiction has a sales tax at all. For example, Oregon, Montana, New Hampshire, and Delaware, all states with no sales tax, collect occupancy taxes.

To File A “zero” $ Return:

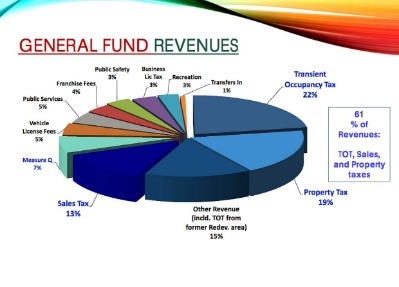

TOT collections are reported and remitted to the Finance Treasury Office based on the month in which the payment is received by the host, not the month in which the occupancy occurred. The Transient Occupancy Tax is a tax of 12% imposed on any person who stays in a hotel, motel, inn, etc., as defined under “hotel”, that are located in Berkeley. The tax is collected from the guest, and is paid to the hotel operator with the intended rent. The TOT is commonly known as a “hotel tax” and applies to transient stays of up to 30 consecutive days. Transient occupancy taxes are levied on facilities that provide accommodations for customers. But that might be the only thing that’s obvious about these taxes. Like sales taxes, transient occupancy taxes — sometimes called hotel or lodging taxes — can get applied in convoluted ways by state and local governments.

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. For more information regarding your eligibility to apply for a STR Permit, please visit the City’s Short-Term Rentals web page, or call Alex Khoury, Assistant Director of Planning and Community Development, at . Free viewers are required for some of the attached documents. 7.Can a host charge the Short-Term Rental 2% code enforcement fee to the transient?

- The tax is collected by hotel operators and short-term rental hosts/sites, and remitted to the City.

- Services offered to the hosts by the hosting platforms vary.

- The types and volume of companies associated with occupancy taxes are extensive.

- Earning income from a short-term residential rental, regardless of the amount, is considered a business, therefore, you are required to obtain aBusiness Registration.

- Both hotels and short term vacation rentals collect this tax.

- For more information on Short-Term Rental, please visit/str.

To find out how much TOT you need to turn in for each stay, check your city’s Treasurer website. For example, the current transient occupancy tax to collect for any vacation rental stay in San Diego is 10.5%. Though they’re often referred to as hotel taxes, short-term occupancy taxes aren’t limited to commercial hotels. If you rent out your home, or a portion of your home, through a service such as Airbnb, HomeAway or VRBO, they probably apply to your situation, too. The City of Santa Cruz Finance Department had to move its office during the month of June and will no longer be able to accept in-person transient occupancy tax payments at 877 Cedar Street, Suite 100. 15.Who is responsible for collecting Transient Occupancy Tax from guests if I rent through Airbnb, VRBO, or other hosting platforms? The host is responsible for ensuring compliance with the City’s TOT Ordinance, including the collection and remittance of any TOT taxes that apply to their accommodations.

Transient Occupancy Tax (tot)

A Qualified Website Company (“QWC”) has the authority to collect and remit TOT on behalf of short-term residential rental hosts. If all rent is received through a QWC, the QWC collects, remits, and files all TOT for your business. San Francisco residents who rent out any portion of their residence must collect the 14% Transient Occupancy Tax , in addition to the rental amount they charge their guests. This tax is paid by the guest, so the guest will be charged 14% in addition to your listed rental fee. Rental of all or a portion of your residential unit for periods of less than 30 consecutive nights is considered a Short-Term Residential Rental.

Everyone is required to stay home, except for essential needs. When out, protect yourself and those around you by wearing a face covering, staying 6 feet away from others, and washing your hands often. The TOT and TMD assessment must be remitted monthly and is due no later than the last day of the following month. For example, the TOT and TMD assessment collected in the month of April must be remitted by May 31. The penalty is 1 percent of the TOT and TMD assessment due for the first delinquent day, plus one-third (1/3) of 1 percent for each additional day, not to exceed 25 percent.

Everything You Need To Know About Transient Occupancy Tax In California

This information will be used to process claims for refunds in case of duplicate payments. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

To be considered timely, TOT payments must be received or United States Postal Service postmarked by the due date to avoid penalties and interest. If a payment is received after the due date with a late or missing postmark, the payment is considered late, and penalties will be imposed in accordance with County Ordinance No. 10366. You may purchase duplicate tax bills for $1 at any Tax Collector’s office. You may now search for and pay secured, unsecured, defaulted, supplemental, and escape tax bills. Click the “Continue” button below to get started, and follow the prompts to search, select, and pay your bill.

and having to move someone in an emergency as long as you are moving them to one of your other properties is not taxable according to my judgement. This assessment may be passed on to customers as a separate item on hotel folios. unless you only use a Qualified Website Company for your listings, or you earn $40,000 or less in rent per year and request to bea Small Operator. iling/payment due date is January 31st for filing period year of January 1 through December 31. If due date falls on a weekend or legal holiday, filing/payment will be due the next business day. A “Small Operator” has total gross receipts of $40,000 or less annually for one location and does not exceed $250,000 per year for all locations.

The Treasurer-Tax Collector’s Office is responsible for the administration and collection of transient occupancy tax for establishments located in the unincorporated areas of the County. For establishments located within an incorporated city, TOT is collected by the City in which the property being rented is located. The property owner is ultimately responsible for paying the TOT taxes to the City whether it’s collected from the guest or not.

The Good News is, you can now submit your TOT returns and payments online. All due dates and delinquent date apply and will be enforced.

For general rentals, the 1% Berkeley Tourism Business Improvement District fee is added to the TOT remittance to the City. To estimate TOT and BTBID fees, you can use the calculator below. 3.Is a Short-Term Rental subject to Transient Occupancy Tax?

Deductibility On Income Taxes

Just remember, your transaction is not final until you click “Submit” and receive a receipt that says “Successful.” A transient is defined as any person who exercises occupancy or is entitled to occupancy for 30 days or less. I have been aware of this statute for a while and have been meaning to post a blog update as I have received several calls from clients in the last 6 months about this issue. I just published a new blog article on this issue today to alert property owners. Most cities in CA do have the “less than 30 day stay” definition for a transient, but San Diego is unique since our statute is outdated and was enacted prior to the beginning of the STR wave in 2007. Please see the City of San Diego link below for information on “rent”. The tax is due on the total amount charged, and does not account for any deductions.