Content

Read chapter 3 to find out if you can get the earned income credit without a qualifying child. A married person filing a joint return may get more EIC than someone with the same income but a different filing status. As a result, the EIC table has different columns for married persons filing jointly than for everyone else. When you look up your EIC in the EIC Table, be sure to use the correct column for your filing status and the number of children you have.

You, your spouse, and any qualifying child must have an eligible Social Security # that is valid for employment. The Iowa EITC must be divided between spouses in the ratio of each spouse’s earned income to the total earned income of both spouses. Earned income includes wages, salaries, tips, other compensation, and net earnings from self-employment.

If you are self-employed or a statutory employee, you will figure your earned income on EIC Worksheet B in the Form 1040 and 1040-SR instructions. If you don’t have a valid SSN on or before the due date of your 2020 return , enter “No” on the dotted line next to line 27 (Form 1040 or 1040-SR). You can’t claim the EIC on either your original or an amended 2020 return. If you meet all seven rules in this chapter, then read either chapter 2 or chapter 3 for more rules you must meet. send tax questions, tax returns, or payments to the above address. If none of the statements above apply to you, your tax form instructions may have all the information you need to find out if you can claim the EIC and to figure your EIC. But you can read it to find out whether you can take the EIC and to learn more about the EIC.

LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes. In addition, clinics can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee for eligible taxpayers. To find a clinic near you, visit /about-us/Low-Income-Taxpayer-Clinics-LITC/ or see IRS Pub. Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. You can also download and view popular tax publications and instructions (including the Instructions for Forms 1040 and 1040-SR) on mobile devices as an eBook at IRS.gov/eBooks.

- Because you meet the relationship, age, residency, and joint return tests, you are a qualifying child of your mother for the EIC.

- Do not include Social Security numbers or any personal or confidential information.

- The Tax Counseling for the Elderly program offers free tax help for all taxpayers, particularly those who are 60 years of age and older.

- Also, you and your wife aren’t required to file a tax return, but you file a joint return to claim an EIC of $63 and get a refund of that amount.

- For example, if you claim one child, your mother can claim the other two.

Full-time work (or part-time work done at an employer’s convenience) in a competitive work situation for at least the minimum wage shows that the child can engage in substantial gainful activity. An Indian tribal government or an organization authorized by an Indian tribal government to place Indian children. Combine the amounts on lines 11 and 12 of this worksheet. Subtract the amount on line 9 of this worksheet from the amount on line 8.

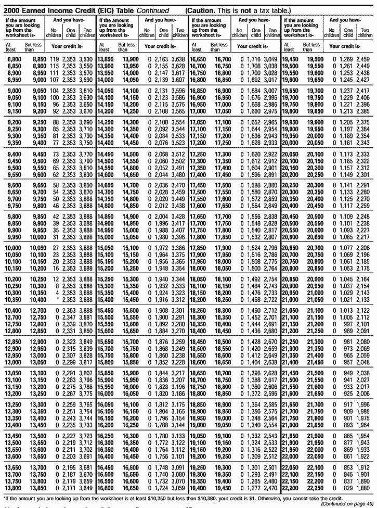

$223 1 $22,322 $1,495 2 $22,309 $2,467 3 or more $22,302 $2,775 The EITC refunds are not counted as income when your CalWorks, CalFresh or Medi-Cal benefits are calculated. For more details, please contact your eligibility worker. To find your credit, read down the “At least – But less than” columns and find the line that includes the amount you were told to look up from your EIC Worksheet.2. This graphic shows a portion of the EIC table to illustrate how to find your credit at the intersection of the appropriate row and column.

Your AGI is $42,550, you are single, and you have one qualifying child. You can’t claim the EIC because your AGI isn’t less than $41,756. However, if your filing status was married filing jointly, you might be able to claim the EIC because your AGI is less than $47,646.

Rules If You Do Not Have A Qualifying Child

An adopted child is always treated as your own child. The term “adopted child” includes a child who was lawfully placed with you for legal adoption. You are a statutory employee if you receive a Form W-2 on which the “Statutory employee” box is checked. You report your income and expenses as a statutory employee on Schedule C . Earned income includes all of the following types of income.

The business application guide explains the process of applying. Tax credit applications will be processed on a first-come, first-served basis by day submitted. All applications received on a specific day will be processed on a random basis before moving on to the next day’s applications. Applications will be approved until the amount of available tax credits is exhausted. An approved company must provide proof to DCED within 90 days of the notification letter that the contribution was made within 60 days of the notification letter.

Let’s start with a basic description of the Earned Income Tax Credit, which is also commonly referred to as the EITC, Earned Income Credit, or EIC. The EITC is a significant tax credit for lower and lower-middle income taxpayers that rewards earned income, particularly for those with children. It was first enacted under the Ford administration in 1975 and was built with the dual purpose of incentivizing the earning of income and reducing poverty.

What Is The Earned Income Tax Credit?

This is because your mother’s AGI, $15,000, is more than your AGI, $9,300. When you file Form 1040 or 1040-SR, you must attach Schedule EIC to your return to claim the EIC with a qualifying child. If you were a nonresident alien for any part of the year, you can’t claim the earned income credit unless your filing status is married filing jointly.

Because he received retirement and regardless of the fact that he had to go back to work full time no earned income. And that fact seems very wrong when many receiving welfare and food stamps will all qualify for the EIC as long as they work about 15 hours a week. Act 15 of 2020 also allows for businesses entering their Year 2 of 2 commitment in 2020 to donate a lower amount in Year 2 of 2 and still maintain their 90% tax credit for both Year 1 and Year 2. Businesses deciding to make a lower contribution amount in Year 2 of 2 will also still be able re-apply during the early application window in 2021. Review the chart below to see how much you may get when you file your tax year 2020 return. Earned income, Rule 7—You Must Have Earned Income, Earned IncomeEarned income credit , EIC TableEITC Assistant, Is There Help Online? Examples, detailed, Detailed ExamplesExtended active duty, Extended active duty., Military personnel stationed outside the United States.

This chapter explains when you need to attach Form 8862. For more information, see Form 8862 and its instructions. To figure the EIC yourself, use the EIC Worksheet in the instructions for Form 1040 and 1040-SR. except George had nontaxable combat pay of $25,000. When George and Janice add their nontaxable combat pay to their earned income, they find their credit to be $2,496.

See Tips for taxpayers who need to file an amended tax return and go to IRS.gov/Form1040X for information and updates. IP PINs are six-digit numbers assigned to eligible taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. When you have an IP PIN, it prevents someone else from filing a tax return with your SSN. Go to IRS.gov/VITA, download the free IRS2Go app, or call for information on free tax return preparation. You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return.

Welcome To The Tax Return Preparer Toolkit

Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. The Greys enter $5,856 on line 27 of their Form 1040. They will now complete Schedule EIC and attach it to their return. They will keep the EIC Worksheet for their records. If your EIC was denied or reduced as a result of a math or clerical error, don’t attach Form 8862 to your next tax return. For example, if your arithmetic is incorrect, the IRS can correct it.

Using the optional methods on Schedule SE to figure your net earnings from self-employment may qualify you for the EIC or give you a larger credit. If your net earnings are less than $5,640, see the instructions for Schedule SE for details about the optional methods. The amount of your nontaxable combat pay should be shown on your Form W-2 in box 12 with code Q. U.S. military personnel stationed outside the United States on extended active duty are considered to live in the United States during that duty period for purposes of the EIC. If it wasn’t, enter “No” on the dotted line next to line 27 (Form 1040 or 1040-SR).

You, your 5-year-old son, and your son’s father lived together all year. Your son is a qualifying child of both you and his father because he meets the relationship, age, residency, and joint return tests for both you and his father. Your earned income and AGI are $12,000, and your son’s father’s earned income and AGI are $14,000. Your son’s father agrees to let you treat the child as a qualifying child. Line 27 Earned income credit Line 28 Additional child tax credit.

Go to IRS.gov/Payments for information on how to make a payment using any of the following options. Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts.

Free Resources To Help You File Your Tax Return

Consult an independent financial advisor for your specific situation. Per FTC guidelines, this site may be compensated by companies mentioned through advertising & affiliate partnerships. Must not file Form 2555, Foreign Earned Income or Form 2555-EZ, Foreign Earned Income Exclusion. In other words, you must have lived in the U.S. for more than half of the year. Your income falls within the eligible income range . You are between 25 and 65 years old at the end of the tax year, usually Dec. 31.