Content

Certain properties, or portions of properties, are exempt from taxation under the California Constitution. The most common types are homeowner, welfare, charitable, and institutional exemptions. View theExemption page for more information. Locate property, utilities, and district information, along with locations and maps for area facilities and features. View theE-Map-It page to search for property information. The Assessor’s office electronically maintains its own parcel maps for all property within Sacramento County.

View theE-Prop-Tax page for more information. See more information at marchforsciencesacramento.org. We’re on RED ALERT. After House Republicans passed the GOP’s atrocious tax plan, Senate Republicans are RACING to put it to a vote, and we’re running out of time to stop it.

Last Sales Taxes Rates Update

View theDecline in Value Reassessment page to request an Assessor’s review. The filing period for reviews is July 2 to December 31.

Property information and maps are available for review using the Parcel Viewer Application. For purchase information please see our Fee Schedule web page or contact the Assessor’s Office public counter at . For more information, view theParcel Viewer page. The principal function of an appeals board is to determine the full value of property or to determine other matters of property assessment over which the appeals board has jurisdiction. View theAppeals page for information about appeals process.

Historical Sales Tax Rates For Sacramento

7.25%, 7.75%, 8%, 8.25%, 8.5% are all the other possible sales tax rates of Sacramento area. Every 2021 combined rates mentioned above are the results of California state rate (6%), the county rate (0.25% to 1%), the Sacramento tax rate (0% to 1%), and in some case, special rate (0.5% to 1.5%). Our partner TaxJar can manage your sales tax calculations, returns and filing for you so you don’t need to worry about mistakes or deadlines. There is also 98 out of 106 zip codes in Sacramento that are required to charge a special sales tax for a ratio of 92.453%. Please refer to the California website for more sales taxes information.

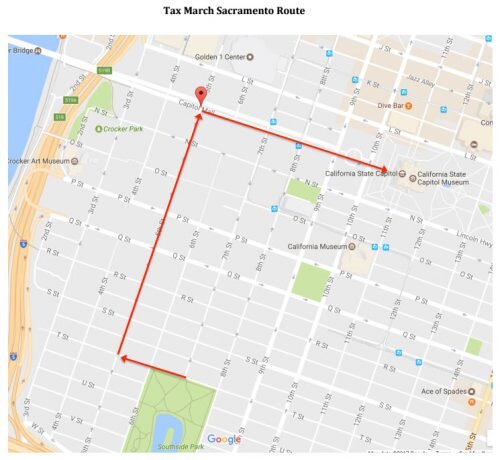

Within days of his inauguration, the White House petition calling on President Trump to release his tax returns garnered the most signatures on a White House petition, ever. Tax March Sacramento fights for transparency, and against corruption and corporate greed. Tax March Sacramento is a ‘project’ of Social Good Fund 501. TMS is completely volunteer led, and all donations go to the logistics of the march and public education.

Largest Cities Of California(by Zip Code Qty)

The 8.75% sales tax rate in Sacramento consists of 6% California state sales tax, 0.25% Sacramento County sales tax, 1% Sacramento tax and 1.5% Special tax. The sales tax jurisdiction name is Sacramento Tmd Zone 1, which may refer to a local government division. For tax rates in other cities, see California sales taxes by city and county. There are approximately 23,036 people living in the Sacramento area. Remember that zip code boundaries don’t always match up with political boundaries , so you shouldn’t always rely on something as imprecise as zip codes to determine the sales tax rates at a given address. There is 31 out of 106 zip codes in Sacramento that are being charged city sales tax for a ratio of 29.245%.

We support transparency in government, and NOT ONE PENNY of tax cuts for millionaires and billionaires. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Businesses impacted by the pandemic, please visit our COVID-19 page (Versión en Español) for information on extensions, tax relief, and more. The last rates update has been made on July 2021. The Sacramento’s tax rate may change depending of the type of purchase. If your property’s market value is less than its assessed value, you may file for an informal Assessor review.

Privately and commercially-owned boats and aircraft are also subject to personal property taxes. View theBoatsandAircraftweb pages for more information. Owners who suffer damage to their property as the result of a disaster or calamity may be eligible for certain, limited forms of property tax relief. Some types of new construction are excluded from property tax assessment. View theGeneral Information page for more information. This includes Secured and Unsecured supplemental, escaped, additional and corrected tax bills issued for property taxes on real property. This does not include personal property tax bills issued for boats, business equipment, aircraft, etc.

- This includes Secured and Unsecured supplemental, escaped, additional and corrected tax bills issued for property taxes on real property.

- View theE-Map-It page to search for property information.

- Our partner TaxJar can manage your sales tax calculations, returns and filing for you so you don’t need to worry about mistakes or deadlines.

- We’re on RED ALERT. After House Republicans passed the GOP’s atrocious tax plan, Senate Republicans are RACING to put it to a vote, and we’re running out of time to stop it.

- Locate property, utilities, and district information, along with locations and maps for area facilities and features.