Content

You must file a Form 1040 Schedule A form in order to tally your itemized deductions. Make sure you keep records of those items you deducted in case you’re audited by the IRS. If you owed money when you filed your state tax return for 2015 and paid them in the spring of 2016, be sure to deduct them on your 2016 federal return. If you did the math and didn’t have enough itemized deductions to get you above $6,350 for singles and $12,700 for marrieds, you can take the standard tax deduction. If you are filing as head of household, you can deduct $9,350.

- Consult an attorney for legal advice.

- This allows you to deduct the actual amount of certain expenses from your taxable income .

- Claiming tax deductions is a powerful strategy for tax filers.

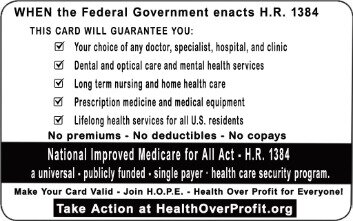

- A new deduction for 2020 is for charitable contributions of up to $300 to qualified organizations.

Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income .

For Simple Tax Returns Only

If you’re in the 22% tax bracket and single, this means that you’ll save $44 as compared with the 2019 standard deduction. If you’re married filing jointly, you’ll save $88. And if you’re in a higher tax bracket, your savings will be even more. For 2020, the standard deduction is rising by $200 to $400, depending on your filing status. To be clear, this is the amount of your adjusted gross income that you can exclude from federal income taxes.

Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

One strategy filers can use is to double up their donations in a single tax year, perhaps donating once in January and again in December. Claiming tax deductions is a powerful strategy for tax filers. Using appropriate deductions can lower your bill, increase your tax refund or make sure you’re taking advantage of tax benefits offered by your federal and state governments. If you’re paying your own tuition for a graduate course or other training, you may qualify for a Lifetime Learning Credit that’s worth 20% of up to $10,000 of qualifying expenses.

Standard Tax Deductions Tax Year 2021: 01

As married filing separately, if one spouse itemizes deductions, the other spouse can not claim the standard deduction. Furthermore, when you prepare and e-File your 2020 Tax Return on eFile.com, the eFile Tax app will work for your benefit and either apply or recommend standard deductions or itemized deductions.

Filing a new W-4 form with your employer will insure that you get more of your money when you earn it. If you’re just average, you deserve about $225 a month extra. Try our easy withholding calculator now to see if you deserve more allowances. Sometimes you might file a return, for example, to get a refund of withheld money, even though you can be claimed as a dependent on someone else’s return. Account executives, customer relationship management, and other personnel are not licensed service providers. These staff members cannot provide personalized accounting, legal, business structure, or other tax advice.

Kevin O’Leary is a partner and strategic advisor for Tax Hive. We know that many business owners spend very little time with their tax accountant and in so doing bring on more risk of an audit.

Irs Releases 2021 Tax Rates, Standard Deduction Amounts And More

Get your taxes done by a tax pro in an office, via video chat or by phone. Or do your own with expert, on-demand help. Gather your docs and let your tax pro do the rest. Just review and approve your return. Meet in an office or via chat, phone, or video.

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years.

That means that you can gift $15,000 per person to as many people as you want with no federal gift tax consequences in 2021; if you split gifts with your spouse, that total is $30,000. The exclusion amount for gifts to a spouse who is not a citizen of the United States is $159,000. The federal estate tax exemption for decedents dying will increase to $11.7 million per person or $23.4 million per married couple in 2021.

You must file Form 1040 and Schedule A to itemize. Timing is based on an e-filed return with direct deposit to your Card Account. Use of for Balance is governed by the H&R Block Mobile and Online Banking Online Bill Payment Agreement and Disclosure. Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account.

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only.

Each of those reinvestments increases your tax basis in the fund. That lowers your amount of taxable capital gains when you eventually sell your shares. Listen Money Matters is reader-supported.

What Is The Single Filing Status?

If you’re unmarried and have no kids, chances are you’ll file your federal income tax return under the single status. But to save money, it pays to check whether you qualify as head of household or another more-beneficial tax-filing status. Credit Karma Tax®, which is always free, can help you choose your tax status. Single is one of the five tax-filing statuses that the IRS recognizes.

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

The single filing status is typically the “least favorable, so just make sure you look at all your circumstances before you check the box that says you’re single,” she says. But how do you know when to file as single or when you can file with another status? Let’s take a look at the requirements. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. The $300 charitable contribution deduction.

If your filing status for the 2020 tax year is single, you can take a standard deduction of $12,400. And it could be higher if you’re 65 or older or are blind. Additionally, this rule does not apply if the dependent makes equal to or greater than the standard deduction for their filing status. Learn more about how to file a tax return as a dependent. These standard deduction amounts are for 2020 Tax Returns that are due on April 15, 2021. You can e-File 2020 Tax Returns until Oct. 15, 2021, but late filing or late tax payment penalties might apply if you owe taxes.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates. Turkey is not necessarily aiming to return to the U.S. F-35 fighter jet programme from which it was removed over its purchase of Russian defence systems, the Turkish defence industry chief said on Wednesday.

Interest You Paid

Most taxpayers claim the standard deduction amount, as it’s easier than itemizing and for most people results in a smaller tax bill. In 2018, an estimated 90 percent of U.S. households opted for the standard deduction rather than itemizing. Tax Hive is a leading source for business tax preparation, estate planning and asset protection.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. The threshold to report gifts from certain foreign persons in 2021 is $16,815.

So it’s likely that you’ll use the standard deduction on your 2020 tax return. You can deduct your expenses via standard deduction or itemized deductions. Not sure whether to itemize deductions or use the standard deduction? When youprepare and e-File your tax return on eFile.com, we will make this easy for you and you can be assured that the results are in your best interest based on the latest tax reform changes. If you have questions, you can always contact one of our Taxperts. The single filer’s taxable income can be reduced to $37,600 using the standard deduction of $12,400.