Content

Undergraduate students taking only a few courses are also more likely to take the Lifetime Learning Credit because there is no minimum enrollment requirement. Set a deadline for when you’ll have your W-2 forms, 1099 forms, investment income information, last year’s tax refund, student loan interest and the rest of the items listed on the IRS Tax Form checklist. By breaking the intimidating task of filing your taxes into smaller chunks, you have a better chance of avoiding a last-minute marathon session to meet the filing deadline. For a student loan to qualify for the deduction, you must have used the loan to pay higher education expenses for yourself or for one of your dependents .

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Finally, the last $600 of the refundable credit is paid to you as a tax refund. That means a portion of the credit will be refunded to you even if you don’t owe any federal income tax.

What Education Expenses Qualify For A Tax Credit?

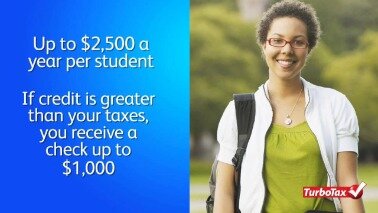

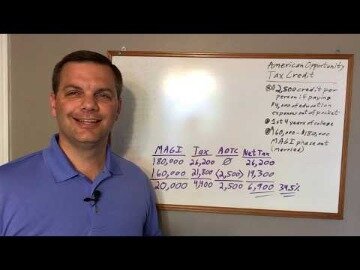

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to $1,000) can be refunded to you. Room and board aren’t covered, nor are expenses you might pay with tax-free education assistance. You can’t count the same expense twice for more than one educational tax credit or deduction. This makes the AOTC more valuable than some other educational tax credits and deductions. It can help offset the alternative minimum tax and the self-employment tax because it’s partially refundable. He previously worked for the IRS and holds an enrolled agent certification.

She codeveloped an online DIY tax-preparation product, serving as chief operating officer for seven years. “It makes planning kind of difficult because you never know if the tax breaks are going to be there,” Orsolini says. The MAGI phase-out range for married couples filing jointly is $118,000 to $138,000.

Still, it’s important to follow IRS guidelines on who’s eligible and how to claim the tax breaks. Here’s how the American opportunity tax credit, lifetime learning tax credit, student loan interest deduction, earned income tax credit, and the tuition and fees deduction could potentially benefit you. Claiming college tax credits and deductions can help defray the costs of certain expenses, such as tuition, fees, books and supplies. You can claim the American Opportunity credit for qualified education expenses you pay for a dependent child as well as for expenses you pay for yourself or your spouse. If you have several students in your family, you can claim multiple credits based on the expenses of each student.

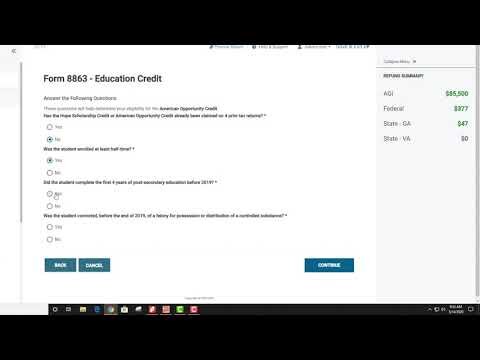

UseForm 8863to calculate the exact amount of the tax credit you’re entitled to and attach it to your Form 1040 tax return. The AOTC is gradually reduced—referred to as “phasing out”—for single taxpayers with modified adjusted gross incomes of $80,000, or $160,000 for married taxpayers who file joint returns. Congress sometimes adjusts various phase-outs to keep pace with inflation. Up to $5,250 of education assistance benefits are yours tax-free in tax year 2020, but you must pay income tax on any amounts you receive over $5,250.

Take Advantage Of Two Education Tax Credits

These include tax credits, deductions, and tax-free savings options. But the IRS doesn’t generally allow you to take more than one benefit per student per year. Know which are available to you and their differences so you can select the best one to claim.

The educator expense deduction is for teachers rather than students. It is worth up to $250 of expenses that you paid out of your own pocket for the benefit of your students. The limit increases to $500 if you’re married and filing a joint return and both you and your spouse are educators. The American Opportunity Tax Credit is restricted to undergraduates who are enrolled at least half-time for at least one academic period. Graduate students don’t qualify, nor do students who have a felony drug conviction. The credit is partially refundable and equal to the first $2,000 you spend per student plus 25% of the next $2,000 you spend, for a maximum credit of $2,500.

You Could Receive Up To $2,500 For Undergraduate College Costs

Qualified expenses include tuition, fees, books, supplies, equipment, and other course materials as long as they are required . The credit is available for any and all years of post-secondary education as well as for adult and continuing education courses. Qualified expenses include tuition and required fees, books, supplies, equipment, and other required course materials . Students whose tuition and related expenses are waived entirely or paid entirely with scholarships or grants. Yes, you are not required to claim the credit for a particular year. If your child’s college does not consider your child to have completed the first four years of college at the beginning of 2019, you may take the credit in 2020. This means that you’ll receive less of credit if your MAGI is more than $80,000, or $160,000 if you’re married and filing jointly.

- This approach results in an $800 American opportunity tax credit (see the “Original” column in the table “Family With Both Spouses Attending College”).

- The reported amounts do not distinguish between the types of grants or scholarships a student receives; they may even include nonqualified scholarships.

- For your 2020 taxes, this deduction is worth the amount you paid in interest for your student loans, up to $2,500, which is the maximum deduction.

- (A tax credit is a dollar-for-dollar reduction of your tax liability.) You have to choose which benefit to claim because you cannot use the same expenses to claim more than one benefit.

- Tax laws change periodically and the above information may not reflect the most recent changes.

Any tax-free education expenses received from your employer can’t be used to claim any other tax credit or deduction. Earnings in Coverdell Education Savings Accounts are also tax-free up to the amount that they’re used to pay for qualifying education expenses.

How Do I Claim An Education Credit?

However, there’s no limit on the number of years you can claim the lifetime learning credit. If the credit more than wipes out your tax liability for the year, you’ll get a refund check from the IRS for 40% of the remaining amount, up to $1,000, for each qualifying student. To claim the tuition and fees deduction, you must have paid qualified education expenses for a student who is enrolled in one or more courses at an eligible educational institution. To maximize their credit, the couple can use their combined $6,000 of scholarships and grants to pay for $6,000 in nonqualified education expenses and report the $6,000 as taxable income. The couple’s qualified education expense would no longer be reduced by the qualified scholarships and grants. Thus, they could each claim $4,000 in qualified education expenses when calculating the education expenses (see the results in the “AOTC” column in the table “Family With Both Spouses Attending College”).

Kim Porter is a writer and editor who has written for AARP the Magazine, Credit Karma, Reviewed.com, U.S. News & World Report, and more. Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years.

You are legally responsible for what’s on your tax return, even if it is prepared by someone else. For more information, read IRS’ Tips for Choosing A Tax Return Preparer. A. For most alien individuals present in the U.S. on an F-1 Student Visa, the answer is no. Thus, if you are an alien individual with an F-1 Student Visa, you are probably a nonresident alien.

Here’s how the American Opportunity tax credit and Lifetime Learning credit, another helpful education tax credit, can help offset the rising cost of attending college. Qualified expenses include tuition and mandatory enrollment fees at an eligible institution. Books and course materials can also count, but only if you are required to purchase them directly from the school. Other expenses, such as optional fees and room and board, do not qualify. Additionally, the Lifetime Learning credit can also help cover the cost of graduate school and of courses taken to maintain or improve job skills. An eligible educational institution is a school offering higher education beyond high school. It is any college, university, trade school, or other post secondary educational institution eligible to participate in a student aid program run by the U.S.

If your federal income tax bill is $4,500, the $1,500 nonrefundable portion of the credit reduces your tax bill to $3,000. Then the $1,000 refundable credit further reduces your tax bill to $2,000. Use our free tax tools to calculate taxes or determine eligibility for certain tax credits. The amount of your credit will be 20% of the first $10,000 of combined post-secondary tuition and fees you paid, totaling no more than $2,000 . 40% of the credit is refundable, so you may receive $1,000 per eligible student as a tax refund even if you owe no tax. A. A taxpayer claims an education tax credit by completing Form 8863, Education CreditsPDF, and attaching it to Form 1040or 1040-A. A. You will be able to reduce your tax liability by one dollar for each dollar of credit for which you’re eligible.