Content

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy.

Your request for a reduced installment agreement user fee was denied. Learn how to address letter 4213C with help from the tax experts at H&R Block. You’ll report amounts from Form 1099-R as income. This is because it’s income in respect of a decedent.

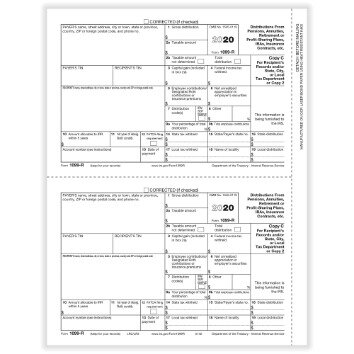

A rollover occurs when you move funds from one account to another. You do not typically have to pay taxes on this money. Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is used to report retirement benefits.

R: How Do I Enter Distributions From Pensions, Annuities, Or Other Retirement Plans?

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Visithrblock.com/ezto find the nearest participating office or to make an appointment. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income .

The following table provides information on all the possible distribution codes in Box 7 of Form 1099-R. Taxpayers receive Form 1099-K if the dollar amount or quantity of their business transactions tops a certain threshold during the year. Form 1099-INT is issued by all financial institutions to investors at the end of the year. It includes a breakdown of all types of interest income and related expenses. All financial institutions and payers of interest must issue a 1099-INT for any party to whom they paid at least $10 of interest during the year. Vanilla Reload is provided by ITC Financial Licenses, Inc.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Relation To Other Forms

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview.

- Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ).

- Your request for a reduced installment agreement user fee was denied.

- You do need to report all retirement-account distributions on your federal tax return, even if they’re tax-free rollovers.

- Retirees should expect to receive their 1099-R on the last day of January.

- If the annuity starting date was after July 1, 1986, you may be required to use the Simplified Method Worksheet.

Our 60,000 tax pros have an average of 10 years’ experience. We’re here for you when you need us. We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years. “The response team was very quick in responding to my problem, and they were able to resolve the issue… E-file is a great service for small businesses like ours.” As an authorized e-file transmitter, we’re committed to secure and accurate e-filing to the IRS and e-delivery to recipients.

Early Distributions

May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. Form W-4P “Withholding Certificate for Pension or Annuity Payments” is filed by payment recipients to inform payers the correct amount of tax to withhold from their payments. This amount is reported on Form 1099-R.

If you withdrew money from your retirement account for the first time this year due to COVID-19, you will need to file Form 1099-R. Indirect rollover funds are subject to a . Therefore, you must use other funds to make up for that 20% deficit to ensure that the withdrawn amount is equal to the deposited amount.

This includes income from disability benefits,life insurance contracts, pension plans, retirement benefits from an annuity contract or retirement plan, and investment income. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required.

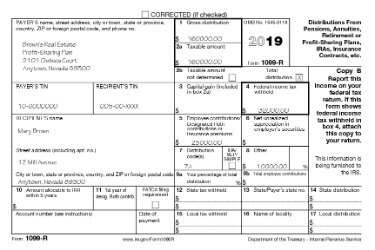

Learn more about notice CP15, why you received it, and how to handle the notice with help from the tax experts at H&R Block. Box 6shows that you received a distribution of employer’s securities from a qualified pension plan. Box 2ashows the portion of this distribution, which is taxable.

Release dates vary by state. Online AL, DC and TN do not support nonresident forms for state e-file.

Generally, Box 14 will be the same amount as Box 1 or Box 2 distributions. Indirect rollovers, on the other hand, have taxes and sometimes even penalties if you don’t reach the age requirement . In an indirect rollover, a retiree or investor withdraws money from an IRA, transfers it to another retirement account, and gets a 20% federal income tax withholding. A direct rollover, which isn’t taxable.

Before sharing sensitive information, make sure you’re on a federal government site. Boxes 12 – 17show any state amounts withheld, and any portion of the distribution reported to the state.

Create an account online for FREE — you don’t pay anything until you’re ready to file your first form. Prepare, file and deliver your 1099 and W-2 forms, any time from anywhere. To show when you started receiving distributions, Box 11 will show the year of your first income reportable by 1099-R. Box 9 deals with two things. The first section states if you’re only one part of the beneficiary of the distribution, meaning you share the income with another. The second part shows your total remaining funds in a life annuity.

Our e-filing experts have compiled step-by-step guides and helpful hints for common tasks such as printing, e-filing, reporting and much more. Should you need additional help, our customer service representatives are available via Live Chat and through email. We support many 1099 & W-2 form types, sure to meet the employee or contract worker reporting needs of your small to midsize business. Browse the full list of available forms. Boxes 12 to 17 will show any state taxes your state and local government withholds. Box 5 shows any contributions to a Roth account or any insurance premiums.

Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. You asked and we listened. We created one easy-to-use place for retirees, survivor annuitants, and their families to find top support content, like FAQs, step-by-step guides to using online tools, and more.

Form 1099-DIV is an IRS form sent by banks and other financial institutions to investors who receive dividends and distributions from investments during a calendar year. Form 1099-R is used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions.

Starting price for state returns will vary by state filed and complexity. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

Like most 1099s, 1099-R forms must be sent to recipients by Jan. 31 of the year following the tax year. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . TurboTax® offers limited Audit Support services at no additional charge. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details. Box If state or local income tax was withheld from the distribution boxes may show all or part of the distribution as taxable to the state. If there are withholdings listed in Box 12, Box 14 must have a value.

There are other situations when you might get a 1099-R before you retire. If the custodian files with the IRS electronically, the form is due by March 31. The plan owner, the IRS and the municipal or state tax department all receive a copy of the form. These copies are used to cross-reference individual tax returns to ensure compliance. Any person who receives an erroneous 1099-R form should immediately contact the plan custodian who sent it in order to rectify the situation and avoid filing an incorrect tax return. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.