Content

US Expat Tax Guides Download one of our comprehensive tax guides today that fits your individual tax situation and provides you with the facts you need. The answer to this question comes down to whether your stimulus check increases your “provisional income.” Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. IRS Free File & How to Get Free Tax Preparation or Free Tax Help in 2021 by Tina Orem Here’s where to get free tax software, free tax preparation and free tax help this year. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you.

Without making some big purchases or holding a substantial real estate portfolio, it will likely be harder to hit the new $10,000 cap. Even if a person legitimately relocates to another state and establishes domicile/residence there, it does not necessarily mean the person is free of income tax in the former state.

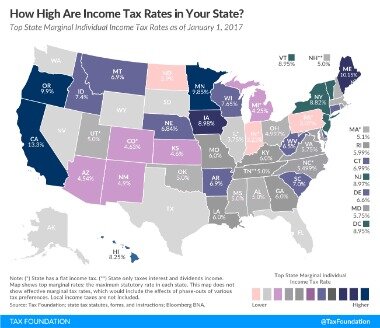

State Tax Rates

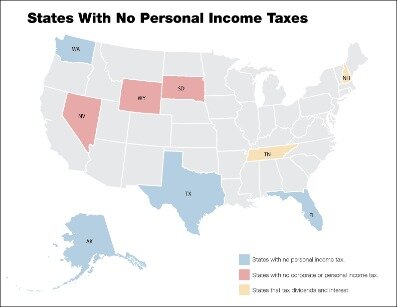

In 2017 , county and municipal property tax levies throughout Texas ranged up to 2%. You can choose to live and work in a state with lower or no income taxes in order to reduce your tax obligation — but remember there may be trade-offs. Before you decide to relocate for a job or to avoid state-level income taxes, research other cost-of-living factors in the state. This includes things like sales tax and property taxes . States get revenue through taxes, much like the federal government does. Seven states have no state-level individual income tax. But these states could make up this lost income in a variety of ways.

Sales tax and property taxes are two key ways that states can earn money in lieu of income tax. Some states allow taxpayers to e-file state returns for free directly through the state’s tax agency website. Others participate in state-level versions of the Free File Alliance, which may allow you to file for free depending on factors like age, income or military status. Learn more aboutfiling state taxes for free.

What About Income Before You Moved?

When you file your Form 1040, you’re reporting and paying your federal income taxes. Depending on where you live and/or work, you may also have to report and pay state income taxes by filling out and filing a state-level tax return. Paying taxes is a part of life for most Americans.

A state without an income tax may have higher sales taxes to compensate, effectively creating a regressive tax system in which taxes consume a bigger portion of lower-earners’ income. To compare, California has some of the country’s highest income tax rates, up to 13.3% for single individuals earning $1 million or more. Nine states in the U.S. don’t levy income taxes, which may save some residents money. But experts say to consider these things if you’re looking to move to one of them. But personal income tax relief and elimination does more than that.

You would need to report all income on your state tax return and pay taxes to the state, even if you didn’t live in the state during the year! Learn more about these sticky states here. Generally, most states only require you to file a state tax return if you lived in the state during the year and usually only tax income generated within the state (view your state’s government website to learn more). Sometimes, income from sources received while living abroad may be taxed in the state, such as retirement payments or investment income . Be mindful of state sourced income when planning your tax for expats, since that income could create a tax-filing requirement for you.

Consideration 9: Penalties For Unpaid Estimated Taxes

New York and California are two of the most expensive states in the country in which to live, in large part due to the heavy tax burdens residents must pay, which include income taxes, property taxes, and sales taxes. Florida and Nevadaare two of nine states in the U.S. that don’t levy income taxes as of 2020 — meaning that people who live and work in those states stand to potentially save a lot of money.

Unearned income is generally allocated to the state where you were living at the time you received it. For example, the income would be attributed to your new state if you sold stock at a gain just after you moved there. Earned income derives from wages, salaries, and tips, while unearned income comes from non-employment sources. Some examples of unearned income include interest, dividends, some Social Security benefits, and capital gains.

Spouses who have been used to keeping their assets separate may want to use a postnuptial agreement designed to nullify community property laws. Those with prenuptial agreements should have them.

- All four of these states have very stringent residency definitions in comparison with other states and they tax worldwide income.

- Forbes used IRS migration data to reveal over 3.1 million net U.S. citizens relocated to states without income tax between 2011 and 2018.

- Rapid Reload not available in VT and WY.

- However, Tennessee will lose its asterisk on January 1, 2021, which is when the phaseout of the state’s investment income tax, dubbed the Hall Tax, is completed.

- Average combined state and local sales tax values are for 2020 and were compiled by the Tax Foundation.

When you’re moving there’s a ton of things to take care of, so keep these important tips in mind. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She codeveloped an online DIY tax-preparation product, serving as chief operating officer for seven years.

Is it better to live in a state with no income tax? It’s a great question considering we already have to set aside a portion of our paychecks for the federal government. The Lone Star State is already one of the seven U.S. states that forgo individual income taxes as of 2019. In November, Texas ballots will ask residents to add a ban on enacting an income tax on individuals to the state’s constitution. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Even if you have a loss on the rental and might not have to file a return in your old state, consider filing a return anyway so that you can establish with your old state that the rental property produced a taxable loss. This might come in handy if you want to carry that loss over to offset some rental income taxable by your old state in the future.

Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. Terms and conditions apply; seeAccurate Calculations Guaranteefor details.

This article was fact-checked by our editors and a member of the Credit Karma Tax® product specialist team, led by Senior Manager of Operations Christina Taylor. It has been updated for the 2020 tax year. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox.

When moving, inform the IRS of a change of address by filing Form 8822,Change of Address. If a taxpayer also relocates a business, the IRS should be notified on Form 8822-B,Change of Address or Responsible Party—Business. When a married couple moves to a community property state—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, or Washington —a new legal matter is introduced. On a day-to-day basis, community property laws are invisible; however, when it comes to divorce, death, and taxes, these laws can make a big difference.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. If you are receiving retirement income from a business in your old state but you move to a new state, federal law says that your new state can tax your retirement income, but your old state can’t. If your employer is moving you from state to state and paying for your moving expenses, some of your reimbursed moving expenses could be tax-free, but some might appear on your Form W-2 as part of your taxable income. Other income generated from a state source – like pension/retirement income or government benefits – may be taxable if you’re a resident of the state. If you’re waiting for your tax refund, the IRS has an online tool that lets you track the status of your payment. NerdWallet strives to keep its information accurate and up to date.