Content

This post tells you what you need to do to be eligible for this credit, and some other things to think about before committing to it. “You can include only the expenses you paid in 2013. If you paid by check, the day you mailed or delivered the check is usually considered the date of payment”. Since the check is freely given in payment in December, the expenses can be deducted in December even through the check clears in January. Click Continue twice and you will then be on the page where you enter your car or other major purchases.

State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file.

One Group Of Taxpayers Won’t Benefit From The New Break

If you drove 6,000 miles for work, all you have to do is multiply that by .58 cents. This will give you a total tax write-off of $3,480. Although those expenses may not seem like a lot, the total costs can add up quickly. We highly recommend you use an expense tracker app to keep receipts and mileage logs throughout the year.

While the cost of overhauling a business vehicle doesn’t qualify as a deduction , the cost of repair can be deducted. Many charitable organizations will even pick up your donated car for you. This method of tax deduction can apply to personal or business application, just make sure you get an official receipt from the charity, which should include the value of the vehicle you donated. Cars are one of the most expensive items to own, both in terms of the initial investment we make in them and in the cost of ongoing maintenance.

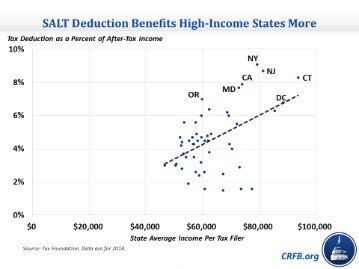

For sales tax deductions, you can either claim the amount you paid over the year — which means keeping a lot of receipts — or take a standard deduction set by the IRS. This amount varies with sales tax rates in each state, as well as your income level and exemptions. Even if you choose the standard sales tax deduction, the IRS allows you to add sales tax paid on “big-ticket” items such as cars, boats and airplanes. The IRS does not allow you to deduct sales tax as well as state income tax.

The IRS says that’s exactly what it is regardless—a tax—at least under most circumstances. Keeping your current car but wanting to reduce emissions? Look into a electric drive conversion kit, which you can hire a professional mechanic to install onto your car.

How To Get A Section 179 Deduction For Buying A Business Vehicle

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Enter the amount of interest on form Schedule C to record this deduction as a business expense. Therefore, it is useful to very large businesses spending more than whatever Section 179’s spending limit is for that year because they can still reduce their taxes with bonus depreciation.

Form 4562 Section 179 takes into account the depreciation use of company machinery, vehicles, furniture, and other property listed either purchased or financed. In this article, we will go over how to save money on your tax bill when you purchase a new car. The IRS defines personal property as “movable” property, as opposed to real estate. Examples include planes, boats, RVs, and motorcycles. The tax must be an ad valorem tax based on the value of the property.

Unfortunately, the credit program phased out, so hybrid car purchases after January 1, 2011 cannot be claimed on your taxes. Businesses might be eligible for this tax deduction too, if you’ve purchased a new hybrid car or restocked your business fleet with hybrid vehicles prior to the deadline. While hybrid vehicles can be fairly expensive, the offset from a tax deduction, plus the money you’ll save in fuel, can make this a smart investment.

And the bonus depreciation program will expire after 2026, unless Congress extends it. To qualify as a “heavy” vehicle, an SUV, pickup or van must have a manufacturer’s gross vehicle weight rating above 6,000 pounds. You can verify the GVWR of a vehicle by looking at the manufacturer’s label, which is usually found on the inside edge of the driver’s side door where the door hinges meet the frame. Examples of suitably heavy vehicles include the Audi Q7, Buick Enclave, Chevy Tahoe, Ford Explorer, Jeep Grand Cherokee, Toyota Sequoia, and many full-size pickups. For tax years after 2018, these amounts will be adjusted annually for inflation. The inflation-adjusted figures for 2020 are $1.04 million and $2.59 million, respectively.

- This can provide a huge tax break for buying new and used heavy vehicles.

- When you use an ATM, we charge a $3 withdrawal fee.

- H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated.

- Moving expenses as tax-deductible costs have been abolished for most of us but members of the U.S. military and their families may still qualify.

- This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

- There are limits on the total amount you can transfer and how often you can request transfers.

So if you paid $10,000 in other qualifying taxes and your total comes out to $10,060 when you include the tax portion of your vehicle registration fee, that $60 can’t be claimed. All your state and local taxes would be deductible, however, if they added up to $9,060 because this total comes in under the cap.

Taxes On Unemployment Benefits: A State

At the time of publication, the law on sales tax deductions expired with the 2011 tax year and was up for renewal by Congress. It may or may not be extended for 2012 and beyond, depending on negotiations on Capitol Hill.

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment.

This allows you to put in the actual amounts paid. You will need to have receipts as proof for these amounts. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Line balance must be paid down to zero by February 15 each year.

In some places the locality assesses an additional sales tax on vehicles that is above the general rate. If deducting sales taxes on the Schedule A, the amount you should deduct for this vehicle is 7% of the car’s cost , and you should not deduct the additional 3% local vehicle sales tax. The stimulus lets you write off state and local sales taxes and excise taxes on vehicles, including new cars, light trucks, motor homes and motorcycles bought from February 17 through the end of 2009. You can claim the deduction on your 2009 tax return , regardless of whether you itemize your deductions or claim the standard deduction, which is what most taxpayers choose to do. The purchase agreement you sign at the dealership constitutes your proof that the sales tax was paid in the year you’re claiming it for. If you claim a deduction for sales tax, you should keep the agreement in a safe place, in case the IRS asks for proof that you paid it.

Holding a bachelor’s degree from Yale, Streissguth has published more than 100 works of history, biography, current affairs and geography for young readers. Timing is based on an e-filed return with direct deposit to your Card Account. Use of for Balance is governed by the H&R Block Mobile and Online Banking Online Bill Payment Agreement and Disclosure. Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use.

Price for Federal 1040EZ may vary at certain locations. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. File with a tax Pro At an office, at home, or both, we’ll do the work. Section 179 was designed to be an incentive for businesses to buy equipment and invest in themselves.

Section 179 Deductions Only For Employers

You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.