Content

Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole. Third party providers like Official Payments Corporation are also available to facilitate using a credit card to pay your tax bill. You can also simply file your return and wait for the IRS to bill you, but don’t be surprised if the bill includes interest and penalties.

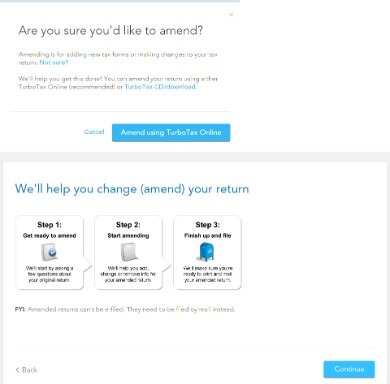

All you need to do is print, sign then mail your return to the addresses that we provide to you. With more than 20 years’ experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at If you are receiving a refund and still haven’t filed, you won’t be penalized for it. If you owe money to the CRA, file as soon as you can because you’ll be paying a late-filing penalty and interest will be charged until you pay the money you owe. The late-filing penalty for the CRA is 5% of your balance due plus 1% for each full month that your return is late up to a maximum of 12-months. IRS Form 1040X is a two-page form used to amend a previously filed tax return.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2020 tax returns, the window closes on April 15, 2024. After three years, unclaimed tax refunds typically become the property of the U.S. If you overpaid for the 2020 tax year, there’s typically no penalty for filing your tax return late.

This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted.

If you do not file a tax return for a refund before the IRS deadline, you will not have any penalties. However, the IRS does have a Statue of Limitations for refunds.

Live Experts Can Help

An S corporation is a “pass-through” entity, meaning that profits and losses from the corporation are reported on the tax returns of individual shareholders who are also responsible for paying the tax on it. For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021, to file those returns. This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRS—as about three out of four taxpayers do every year—then there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension.

She could also be seen helping TurboTax customers with tax questions during Lifeline. For Lisa, getting timely and accurate information out to customers to help them is paramount. TurboTax Live CPAs and Enrolled Agents are available in English and Spanish and can review, sign, and file your tax return. Now that you understand how to file your 2016 prior-year return, what are you waiting for?

Important Tax Dates You Need To Know For 2016

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). You need to show that paying the tax when due would result in a substantial financial loss and that you don’t have the cash, or can’t raise the money, by selling property or through borrowing.

There’s also a late-payment penalty of 1/4 of 1% a month. The 3% 2020 interest rate plus 1/4 of 1% a month adds up to the equivalent of 6% a year. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS. These companies charge a convenience fee (around 2.5% of the amount being paid) for their service. You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible. The consequences differ depending on whether you owe the IRS money or the IRS owes you a refund. If you expect to owe money, you’re required to estimate the amount due and pay it with your Form 4868.

Turbotax Guarantees

IRS reports that they have close to $1 billion in unclaimed refunds. Either way if you have already filed or not filed you should save both the .tax file and the pdf file to your computer so you will always have access to it. You might need to amend it or need a copy to get a loan, etc. If you haven’t filed or finished yet you only have until Monday Oct 16 to finish and efile.

If they already claimed you, they most likely claimed your college tuition fees for the education credit already. However, if this doesn’t apply to you, you should file your 2016 taxes and report your education expenses. Since the e-file deadline passed on October 16th, 2017, you cannot e-file your return. ALL taxpayers must paper-file their prior-year 2016 tax return. Regardless, for prior year returns, the IRS requires taxpayers to physically sign their returns. Fortunately, Prior Tax provides you with a downloadable PDF of your tax return.

She has held positions as a public auditor, controller, and operations manager. Prior to becoming the TurboTax Blog Editor, she was a Technical Writer for the TurboTax Consumer Group and worked on a project to write new FAQs to help customers better understand tax laws.

If you’re self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your third-quarter payment is postmarked by September 15, 2021. If you’re self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your payment is postmarked by this date. If you need a copy of your past year tax return, W-2 or 1099-R transcript, we can assist. We have the expertise to retrieve important aged tax documents online for all your needs. It only takes a few minutes of your time to supply us the required information and we will go to work for you with our amazing state of the art retrieving technology. your tax return to the IRS or state since the deadline for e-filing self-prepared past year tax returns has ended.

New! Let A Dedicated Tax Expert Take Taxes Off Your Plate

When approved, extensions to pay are generally limited to six months. Plus, the IRS requires some acceptable form of security before granting an extension of time to pay. The security may be in the form of a bond, notice of lien, mortgage or other means, depending upon individual circumstances. Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

If you still cannot obtain a copy, request an IRS transcript for a detailed summary of all income for the tax year. You can either request this income transcript online or have it mailed to you. Visit TurboTax.ca and see what product fits best for you and your unique tax situation and begin the process of getting the maximum refund possible.

- As anyone who has experienced it can tell you, tax fraud is not something you ever want to deal with if you can help it.

- Generally, you have three years from the tax return due date to claim a tax refund.

- I have a problem…i did not file my 2011 taxes but I did file my 2012 taxes and got a return in 2012…My 2011 taxes I will owe.

- The content on this blog is “as is” and carries no warranties.

- If you have questions, you can connect live via a one-way video to a TurboTax Live CPA or Enrolled Agent to get your tax questions answered.

If you haven’t already funded your retirement account for 2020, do so by April 15, 2021. If you don’t efile by Oct 16 you will have to print and mail it. If you don’t finish your return you will have to switch to the Desktop program. To switch from online to desktop and continue in the desktop version see this…….

Turbotax Online

There’s no need to stress about your missed 2016 tax deadline if you start now by creating an account with Priortax! Our customer care representatives are here to help if you have any tax questions.