Content

These staff members cannot provide personalized accounting, legal, business structure, or other tax advice. Tax Hive is a leading source for business tax preparation, estate planning and asset protection. Kevin O’Leary is a partner and strategic advisor for Tax Hive. We know that many business owners spend very little time with their tax accountant and in so doing bring on more risk of an audit. We believe in forward taxation planning because we don’t like doing taxes in the rearview mirror.

Import your W-2s and PDFs from another online tax service or tax preparer. Existing TaxSlayer customers can pull prior year tax information and compare this year’s tax return with last year’s tax return.

Claims must be submitted within sixty days of your TurboTax filing date, no later than May 31, 2021 (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2021). Audit Defence and fee-based support services are excluded.

Weve Been Helping People Slay Taxes For Over 50 Years

Links to external web sites do not constitute an endorsement by TaxSlayer or its website co-branding providers of the sponsors of such sites or the content, products, advertising or other materials presented on such sites. Failure to Comply With Terms and Conditions and Termination.

TaxSlayer.com Classic includes Live Phone Support. In addition, you can contact TaxSlayer Support specialists by email about any questions you may have. TaxSlayer.com’s Knowledge Center also provides you with valuable tax knowledge and troubleshooting tips. Select the Learn More links or the Helpful Page topics for on screen assistance. You can also enter key words to search additional articles. Jump to the front of the line with priority support via email, live chat, or phone. Please check the contact us link in your my account for the support center hours of operation.

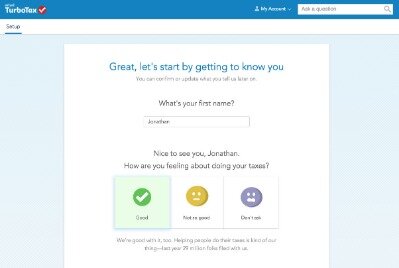

You may have heard the news that the IRS is opening the 2016 tax filing season on January 19, 2016, but there’s no need to wait until then to file your 2015 taxes. TurboTax is accepting tax returns today so that you can be one of the first in line for your maximum tax refund. TurboTax Online prices are ultimately determined at the time of print or electronic filing. All prices are subject to change without notice. If your tax situation is more complex or you’d like expert guidance along the way, try one of the other products in the TurboTax family.

Get Your Maximum Tax Refund With Turbotax Today

And if you need more help, we have you covered from Ask a Tax Pro to Audit Defense. We make switching easy — we’ll autofill your income, wages, and more when you upload a prior year return and import your W-2. You can file confidently with our always up-to-date calculations and 100% accuracy guarantee. If not 100% satisfied, return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price.

It only takes a few minutes of your time to supply us the required information and we will go to work for you with our amazing state of the art retrieving technology. You want all your tax documents on hand, in one place.

- Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources.

- In addition, you can contact TaxSlayer Support specialists by email about any questions you may have.

- By uninstalling TurboTax 2015 WinPerFedFormset with Advanced Uninstaller PRO, you can be sure that no Windows registry items, files or folders are left behind on your computer.

- She has held positions as a public auditor, controller, and operations manager.

- TaxSlayer does not grant any license or other authorization to any user of its trademarks, registered trademarks, service marks, or other copyrightable material or other intellectual property, by placing them on this Website.

- Available to all U.S. residents and resident aliens with an AGI $69,000 or less and age 51 or younger.

Usually, email responses can be expected within 24 to 48 hours. TaxSlayer makes it easy to prepare and e-file your state return. The failure of TaxSlayer to exercise or enforce any right or provision of the Terms of Service shall not constitute a waiver of such right or provision. The Terms of Service and the relationship between you and TaxSlayer shall be governed by the laws of the State of Georgia without regard to its conflict of law provisions. You and TaxSlayer agree to submit to the personal and exclusive jurisdiction of the courts located within the state of Georgia. TaxSlayer is taking reasonable and appropriate measures, including encryption, to ensure that your personal information is disclosed only to those specified by you.

They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

Turbotax Editors Picks

The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Intuit may, but has no obligation to, monitor comments.

Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021. Filing with all forms, including self-employed. Cost of filing state with complex federal return. If you get a larger refund or smaller tax due from another tax preparation method, we’ll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99.

” and personalizes the program to you so you only see questions related to you. You can also take advantage of TurboTax new product enhancements to help you get your taxes done with confidence. TaxSlayer Simply Free includes one free state tax return.

TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work. TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230. Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources.

Pricing is determined at the time or print/e-file and is subject to change at any time without prior notice. Internet connection and acceptance of product update is required to access Audit Defence purchase details. Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself.

If you get a larger refund or smaller tax amount due from another tax preparation engine with the same data, we will refund the applicable purchase price you paid to TaxSlayer.com. TaxSlayer.com’s “Free” products are excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. Income tax preparation software companies must seek NETFILE certification from the Canada Revenue Agency (the “CRA”) for tax preparation software products to be used in conjunction with CRA’s NETFILE electronic tax filing service. All TurboTax software products for tax year 2020 are CRA NETFILE certified.

This is a “fresh” install of the product, I’ve checked our internet connection, and there seems to be no indication of problem from either. Been using this site for several years now, very professional and great customer service.

You can save up to $100 when you file with TaxSlayer! You get all forms, all credits, and all deductions for less than The Other Guys. Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current. The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time.

Online Tax Software

Stuck on your tax return and need technical advice within the program? That’s no problem with our complimentary email and live phone support! A professional support agent will assist you in finding a solution to your question.

We guarantee you will receive the maximum refund you are entitled, or we will refund you the applicable TaxSlayer purchase price paid. This page is not a piece of advice to uninstall TurboTax 2015 WinPerFedFormset by Intuit Inc. from your PC, nor are we saying that TurboTax 2015 WinPerFedFormset by Intuit Inc. is not a good application for your PC. This page only contains detailed info on how to uninstall TurboTax 2015 WinPerFedFormset supposing you want to. The information above contains registry and disk entries that other software left behind and Advanced Uninstaller PRO stumbled upon and classified as “leftovers” on other users’ computers. Run Advanced Uninstaller PRO. Take some time to admire Advanced Uninstaller PRO’s design and number of functions available. Advanced Uninstaller PRO is a very good PC management program. Following the uninstall process, the application leaves some files behind on the computer.