Content

Applies to individual tax returns only. All tax situations are different.

If you have back tax returns, the IRS can charge you expensive penalties, hold your refund and even file a return for you without any credits or deductions in your favor . Due to heavy submissions volume and tax season opening two weeks later than usual, ADOR technical staff are actively working towards accepting and processing individual income tax returns as soon as possible.

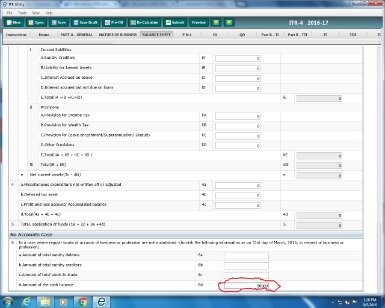

If you have multiple returns to file, it’s more difficult to process the return and manage the resulting penalties and balances owed. You’ll need to investigate your penalty relief options further in these complex situations. If you owe and can’t pay the full amount, consider requesting a payment arrangement with the filed return. After preliminary review, we have determined a problem exists when filing returns using an outdated version of software.

If you are missing any of your tax documents from the last 10 years, you can request a copy from the IRS by filing Form 4506-T, Request for Transcript of Tax Return. If you received a notice, you should send us a copy of the past due return to the indicated address. If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

I do know the IRS will begin processing returns on January 30th this year. And, most taxpayers will have their returns processed within 21 days.

Claim A Refund

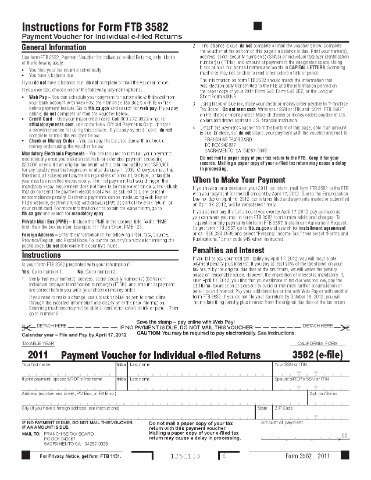

Additional fees may apply from WGU. Timing is based on an e-filed return with direct deposit to your Card Account. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

Just make sure your return is complete and accurate. Also, e-filing with direct deposit is usually the quickest route to take for refunds. I have finsh filing preparing my taxes and when I indicate to have my refund direct deposit nothing happens. So in other words, I do not proceed to any page to know if I taxes are on hold until January 30, 2013. Only TurboTax lets taxpayers talk to certified public accountants, Internal Revenue Service enrolled agents or tax attorneys as often as they like while they’re preparing their tax return, free. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

Offers From H&r Block And Others

A site devoted to articles on current developments in federal taxes geared toward CPAs in tax practice. Please read the information on their web sites carefully before you begin the filing process. You may be charged a fee for filing your taxes electronically if you do not meet the qualifications for Free File.

- If you’re not active-duty military, you can still prepare and e-file the simplest, Form 1040EZ for free withTaxSlayer.

- We hold them until we get the past due return or receive an acceptable reason for not filing a past due return.

- E-file fees do not apply to NY state returns.

- Use this form only to request W-2s, 1099s and even 1098s that may provide support for some of your deductions.

- Block’s website says its free edition also offers free, “live, personal tax advice with a tax professional” via chat and phone, and “in-person audit support.”

HI Sach – Sorry about the delay… This year, the IRS didn’t create a Refund Cycle Chart as they have in past years. I imagine that it would be the same, however, regarding the once per week refunds. The IRS says most taxpayers’ returns will be processed within 21 days.

If Turbo tax is ready and the other tax preparers are ready. If you did not use TurboTax online you can also get copies from the IRS per the support article above. The missing button was the result of a program bug, which has been resolved. You should be able to go in and submit your e-file now.

Submit Previous Year Returns By E

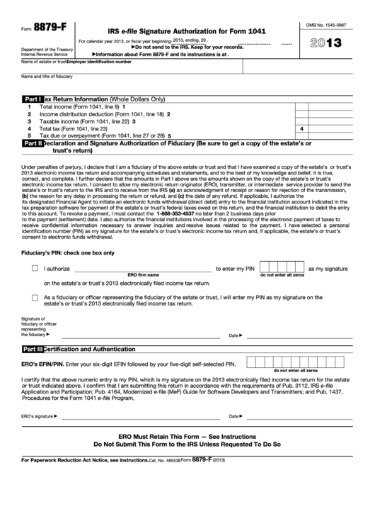

personal identification number ”, either a Self-Select PIN or a Practitioner PIN. 2013 Form 1040 Instructions, at 73 . Here, Mr. Call included a Practitioner PIN on petitioner’s efiled return in accordance with the instructions.

You may have to start there first to prepare e-file everything for free. In New York State, for instance, eligible taxpayers must start at the state’s free filing web page to be linked to the appropriate software, which then handles both state and federal returns for no cost. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited.

Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities.

Filing Your Taxes Late

This return might not give you credit for deductions and exemptions you may be entitled to receive. We will send you a Notice of Deficiency CP3219N (90-day letter) proposing a tax assessment. You will have 90 days to file your past due tax return or file a petition in Tax Court.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. Description of benefits and details at hrblock.com/guarantees. Requesting your tax transcripts is the best way to research your IRS tax account. You can also authorize your tax pro to communicate with the IRS for you.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Though you will not receive a duplicate of the original form, the IRS will provide you with a transcript of all relevant information, which is sufficient for filing your back tax returns. Attach the corrected forms when you send us your completed tax returns. File all tax returns that are due, regardless of whether or not you can pay in full.

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Can’t pay your taxes this year? Learn why you should still file your return even if you can’t pay from the tax experts at H&R Block. Start by requesting your wage and income transcripts from the IRS. These transcripts will help you identify the Forms W-2 and 1099 that you will need to prepare your return.

Tax Fraud

If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit. The key to successfully filing a late tax return is finding all of your tax documents.