Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

When you think about it, those are pretty startling numbers. But another one of the benefits of living in an area like Richmond, is that at the end of the day, we’re just one big small town. Richmonders have a long tradition of coming together, as neighbors and communities. Proof of this lies in the wide array of charities, outreach programs, shelters, clothing closets, thrift shops, and food banks that abound throughout the city and surrounding counties. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

- The National Council of Jewish Women in Los Angeles will give you a receipt for the value of donate goods.

- Hey – I’ve been looking all over far an answer to something, and if I ultimately need a tax attorney, I’ll begrudgingly do that, but wondering if you can help.

- You don’t have to submit documentation along with your tax return but you need to be prepared to provide it at audit.

- My time is much more valuable.

Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. If you have foster children, you can deduct some of the costs of providing for them as a charitable donation. You can deduct the cost that’s more than the reimbursement you receive.

The Salvation Army Mission Statement

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two.

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. All tax situations are different. Fees apply if you have us file a corrected or amended return. Offer valid for tax preparation fees for new clients only.

With all the delays last year due to COVID-19, it seems like that prior tax season just finished. But time and taxes wait for no taxpayer. The Internal Revenue Service, which started 2021 by delivering more coronavirus economic relief payments, says it will be ready for our returns. The monthly tips and reminders a little further down this column should help us focus on our taxes and make the filing of them by go more smoothly. Also keep an eye on the countdown clock just below.

Donation Assistant

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc.

Donating property that has appreciated in value, like stock, can result in a double benefit. Not only can you deduct the fair market value of the property (so long as you’ve owned it for at least one year), you avoid paying capital gains tax. Normally, appreciated property is subject to capital gains tax at disposition but there’s an exception for donations to charitable organizations . Don’t overlook payroll deductions. Increasingly, employees rely on charitable giving opportunities available through their employer.

It is not a recommendation of any specific tax action you should or should not take. Similarly, mentions of products or services are not endorsements. In other words, my ramblings on the ol’ blog are free advice and you know what they say about getting what you pay for. Tax reform enacted in 2017 greatly increased the standard deduction amount.

I don’t recommend estimating the value of your donated items based on what they might sell for at a garage sale. In general, I believe garage sale prices are too low. The content on Don’t Mess With Taxes is my personal opinion based on my study and understanding of tax laws, policies and regulations. It is provided for your private, noncommercial, educational and informational purposes only.

A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

You can use one of this year’s nine participating tax software options if your adjusted gross income is $72,000 or less, regardless of filing status. With a few March days to spare, you’re ready to finish your filing. The IRS recommends you use tax software and e-file your return.

Make A Donation

Charitabledeductions contains many items, but I had a hard time figuring out how I would decide between all the valuation choices for each item. I find it easier to use Itsdeductible with its simple Medium or High value options. Food is accepted the the Food Pantry. The Food Pantry accepts donations of non-perishable food items and household products like toilet paper and detergent.

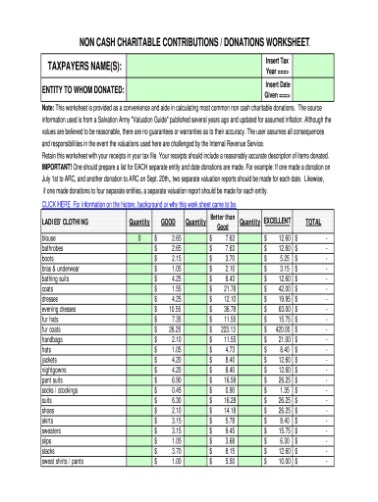

You can use this guide to establish the value of these items. You must keep the records required under the rules for donations of more than $500 but less than $5,000. Cost or other basis and adjustments to the basis of property held less than 12 months. If available, include the cost or other basis of property held 12 months or more. This requirement doesn’t apply to publicly traded securities.

Can I Donate To Charity This Year For A Tax Deduction Last Year?

Management staff must also provide their signature, title, and the signature date. Finally, a copy of completed Form/s 8283 should be forwarded to the Merchandise Analyst. Determining the Value of Donated Property — defines “fair market value” and helps donors and appraisers determine the value of property given to qualified organizations. It also explains what kind of information you must have to support the charitable contribution deduction you claim on your return. I’ve used Itsdeductible for years for my personal taxes and have found it to be easy to use. The Salvation Army and Goodwill lists are very limited and would not be useful for most of the items you may be donating.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

Ready To Donate?

The organization can give you a separate statement for each donation. They could also give you periodic statements proving your donations. If you don’t know whether the organization you’re donating to is IRS-approved, ask for the organization’s tax ID number. Then, check for a list of qualified organizations.

Today is the tax filing deadline for partnerships (Form 1065 with K-1 schedules) and S corporations . Official tax statements aren’t the only things you’ll need to help you file. Other documents have information that’s relevant to your tax return.

All prices are subject to change without notice. Description of benefits and details at hrblock.com/guarantees. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. H&R Block has easy ways to file your taxes, including filing online, using professional tax software or at our tax office locations. Do you own real property in Connecticut? Get your CT property tax rate questions answered with help from the experts at H&R Block.